2000s United States housing market correction (English Wikipedia)

Analysis of information sources in references of the Wikipedia article "2000s United States housing market correction" in English language version.

refsWebsite

Global rank

English rank

1st place

1st place

7th place

7th place

1,303rd place

808th place

99th place

77th place

310th place

208th place

2,737th place

1,700th place

3rd place

3rd place

712th place

526th place

41st place

34th place

45th place

41st place

low place

low place

49th place

47th place

254th place

236th place

low place

low place

low place

low place

241st place

193rd place

269th place

201st place

634th place

432nd place

95th place

70th place

407th place

241st place

9th place

13th place

32nd place

21st place

2,186th place

1,287th place

low place

low place

1,644th place

917th place

low place

low place

low place

low place

low place

low place

54th place

48th place

22nd place

19th place

low place

low place

low place

low place

3,337th place

3,444th place

6,763rd place

3,694th place

2,493rd place

1,714th place

low place

low place

low place

low place

low place

low place

app.com

arizonalisting.info

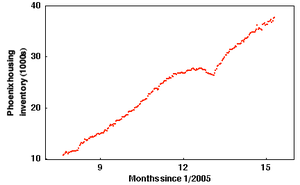

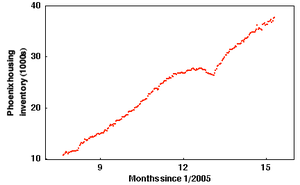

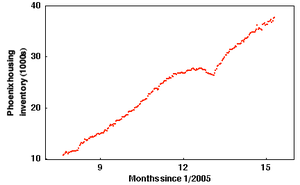

- "Over 14,000 Phoenix For-Sale Homes Vacant". March 10, 2006. Plot of Phoenix inventory:

Inventory of houses for sale in Phoenix, AZ from July 2005 through March 2006. As of March 10, 2006, well over 14,000 (nearly half) of these for-sale homes are vacant. (Source: Arizona Regional Multiple Listing Service.)

barrons.com

online.barrons.com

- Lon Witter (21 August 2006). "The No-Money-Down Disaster". Barron's.

- Laing, Jonathan R. (20 June 2005). "The Bubble's New Home". Barron's.

The home-price bubble feels like the stock-market mania in the spring of 1999, just before the stock bubble burst in early 2000, with all the hype, herd investing and absolute confidence in the inevitability of continuing price appreciation. My blood ran slightly cold at a cocktail party the other night when a recent Yale Medical School graduate told me that she was buying a condo to live in Boston during her year-long internship, so that she could flip it for a profit next year. Tulipmania reigns.

Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005:

Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005.

users2.barrons.com

- "Bear Stearns Hedge Fund Woes Stir Worry In CDO Market". Barrons. 21 June 2007. Archived from the original on 27 September 2007. Retrieved 1 July 2007.

bizjournals.com

- Clabaugh, Jeff (5 October 2006). "Moody's predicts big drop in Washington housing prices". Washington Business Journal.

bloomberg.com

- "Bernanke Says 'Substantial' Housing Downturn Is Slowing Growth". Bloomberg L.P. 4 October 2006.

- Stiglitz, Joseph (8 September 2006). "Stiglitz Says U.S. May Have Recession as House Prices Decline". Bloomberg L.P.

- "Bush Advisers Reduce Growth Forecast for 2008 to 2.7%". Bloomberg L.P. 2007-11-04. Retrieved 2008-03-17.

- "Alt A Loans 'Disconcerting,' Jumbos Weaker, S&P Says". Bloomberg L.P. 27 June 2007.

- "Rate Rise Pushes Housing, Economy to 'Blood Bath'". Bloomberg L.P. 20 June 2007.

books.google.com

- Peter Schiff (February 26, 2007). "Crash Proof:How to Profit From the Coming Economic Collapse". John Wiley & Sons. ISBN 9781118038932.

- How To Prosper In The Changing Real Estate Market

boston.com

- Blanton, Kimberly (26 April 2006). "Housing slowdown deepens in Mass.: Single-family prices, sales slip in March". The Boston Globe.

- Blanton, Kimberly (11 January 2006). "Adjustable-rate loans come home to roost: Some squeezed as interest rises, home values sag". The Boston Globe.

- Blanton, Kimberly (9 December 2005). "Sellers chop asking prices as housing market slows: Cuts of up to 20% are now common as analysts see signs of a 'hard landing'". The Boston Globe.

bostonherald.com

business.bostonherald.com

- "Mass. home foreclosures rise quickly". Boston Herald. 29 August 2006. Archived from the original on November 10, 2006.

businessweek.com

- Paul Magnusson; Stan Crock; Peter Coy (19 December 2005). "Bubble, Bubble – Then Trouble: Is the chill in once-red-hot Loudoun County, Va., a portent of what's ahead?". BusinessWeek. Archived from the original on December 11, 2005.

- Mara Der Hovanesian; Matthew Goldstein (7 March 2007). "The Mortgage Mess Spreads". BusinessWeek. Archived from the original on March 10, 2007.

census.gov

- "Median and Average Sales Prices of New Homes Sold in United States" (PDF). Census.gov. Retrieved 2014-02-21.

- "Median and Average Sales Prices of New Homes Sold in United States" (PDF). Census.gov. Retrieved 2014-02-21.

cepr.net

- Dean Baker (August 2002). "The Run-Up in Home Prices: Is it Real or Is it Another Bubble?".

chicagotribune.com

articles.chicagotribune.com

- Mary Umberger (5 October 2006). "Study sees '07 'crash' in some housing". Chicago Tribune.

cnn.com

money.cnn.com

- Max, Sarah (27 July 2004). "The bubble question: How will rising interest rates affect housing prices?". CNN.

There has never been a run up in home prices like this.

- Zweig, Jason (8 May 2006). "Buffett: Real estate slowdown ahead; The Oracle of Omaha expects the housing market to see "significant downward adjustments", and warns on mortgage financing". CNN.

Once a price history develops, and people hear that their neighbor made a lot of money on something, that impulse takes over, and we're seeing that in commodities and housing ... Orgies tend to be wildest toward the end. It's like being Cinderella at the ball. You know that at midnight everything's going to turn back to pumpkins & mice. But you look around and say, 'one more dance,' and so does everyone else. The party does get to be more fun—and besides, there are no clocks on the wall. And then suddenly the clock strikes 12, and everything turns back to pumpkins and mice.

- This article classified several U.S. real-estate regions as "Dead Zones", "Danger Zones", and "Safe Havens."

Fortune magazine Housing Bubble "Dead Zones" "Dead Zones" "Danger Zones" "Safe Havens" Boston Chicago Cleveland Las Vegas Los Angeles Columbus Miami New York Dallas Washington, D.C. / Northern Virginia San Francisco / Oakland Houston Phoenix Seattle Kansas City Sacramento Omaha San Diego Pittsburgh Tully, Shawn (4 May 2006). "Welcome to the Dead Zone". Fortune.

Welcome to the dead zone: The great housing bubble has finally started to deflate, and the fall will be harder in some markets than others.

- Tully, Shawn (25 August 2005). "Getting real about the real estate bubble: Fortune's Shawn Tully dispels four myths about the future of home prices". Fortune.

- "PIMCO's Gross". CNNMoney.com. 2007-06-27. [dead link]

- Kelley, Rob (14 June 2007). "Mortgage rates: biggest spike in 4 years". CNN. Retrieved 26 May 2010.

contracostatimes.com

- Mozilo, Angelo (9 August 2006). "Countrywide Financial putting on the brakes". The Wall Street Journal. Archived from the original on 20 January 2007. Retrieved 1 July 2007.

economist.com

federalreserve.gov

- Greenspan, Alan (4 April 2005). "Remarks by Chairman Alan Greenspan, Consumer Finance At the Federal Reserve System's Fourth Annual Community Affairs Research Conference, Washington, D.C." Federal Reserve Board.

Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country ...

With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. The widespread adoption of these models has reduced the costs of evaluating the creditworthiness of borrowers, and in competitive markets cost reductions tend to be passed through to borrowers. Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending; indeed, today subprime mortgages account for roughly 10 percent of the number of all mortgages outstanding, up from just 1 or 2 percent in the early 1990s.

forbes.com

- Lereah, David (1 January 2006). "Realtors' Lereah: Housing To Make 'Soft Landing'". Forbes. Archived from the original on October 13, 2007.

ft.com

- "Hard edge of a soft landing for housing". Financial Times. 19 August 2006.

- "H&R Block struck by subprime loss". Financial Times. 21 June 2007.

ghostarchive.org

- " Jdouche (November 2, 2008). "Peter Schiff Was Right 2006 – 2007 (2nd Edition)". Archived from the original on 2021-12-21.

gpo.gov

- The Financial Crisis Inquiry Report - Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States (PDF). The Financial Crisis Inquiry Commission. January 2011. ISBN 978-0-16-087983-8.

institutionalinvestor.com

- Pam Abramowitz (September 16, 2007). "The 2007 All-America Fixed-Income Research Team". Institutional Investor. Retrieved September 7, 2022.

irrationalexuberance.com

- "Home". irrationalexuberance.com.

journalistsresource.org

- "Mortgage Distress and Financial Liquidity: How U.S. Families are Handling Savings, Mortgages and Other Debts". JournalistsResource.org, retrieved June 18, 2012

latimes.com

- Appleton-Young, Leslie (21 July 2006). "Housing Expert: 'Soft Landing' Off Mark". Los Angeles Times.

Leslie Appleton-Young is at a loss for words. The chief economist of the California Assn. of Realtors has stopped using the term 'soft landing' to describe the state's real estate market, saying she no longer feels comfortable with that mild label. ... 'Maybe we need something new. That's all I'm prepared to say,' Appleton-Young said Thursday. ... The Realtors association last month lowered its 2006 sales prediction. That was when Appleton-Young first told the San Diego Union-Tribune that she didn't feel comfortable any longer using 'soft landing.' 'I'm sorry I ever made that comment,' she said Thursday. ... For real estate optimists, the phrase 'soft landing' conveyed the soothing notion that the run-up in values over the last few years would be permanent.

marketwatch.com

- Alistair Barr; John Spence (14 July 2006). "D.R. Horton warning weighs on builders: Largest home builder cuts 2006 outlook on difficult housing market". MarketWatch.

- "DJ US Home Construction Index". MarketWatch. Retrieved 18 August 2006.

- "Toll Brothers lowers outlook: Luxury home builder says buyers still waiting on sidelines". MarketWatch. 22 August 2006.

- Roubini, Nouriel (23 August 2006). "Recession will be nasty and deep, economist says". MarketWatch.

This is the biggest housing slump in the last four or five decades: every housing indicator is in free fall, including now housing prices.

- Katherine Hunt (2 April 2007). "New Century Financial files for Chapter 11 bankruptcy". MarketWatch.

mit.edu

web.mit.edu

- Palmer, Christopher (2013-11-15). "Why did so many subprime borrowers default during the crisis: Loose credit or plummeting prices?" (PDF). Archived from the original (PDF) on 2017-05-17. Retrieved 2014-10-01.

morganstanley.com

- Roach, Stephen S. (16 March 2007). "The Great Unraveling". Morgan Stanley.

In early 2004, he urged homeowners to shift from fixed to floating rate mortgages, and in early 2005, he extolled the virtues of sub-prime borrowing—the extension of credit to unworthy borrowers. Far from the heartless central banker that is supposed to "take the punch bowl away just when the party is getting good," Alan Greenspan turned into an unabashed cheerleader for the excesses of an increasingly asset-dependent U.S. economy. I fear history will not judge the Maestro's legacy kindly.

msn.com

moneycentral.msn.com

- Fleckenstein, Bill (24 April 2006). "The housing bubble has popped". msnbc.com. Archived from the original on 30 April 2010. Retrieved 1 July 2007.

Reports of falling sales and investors stuck with properties they can't sell are just the beginning. Property owners should worry; so should their lenders.

msnbc.msn.com

- "Sales of new U.S. homes surged in April". msnbc.com. 2007-05-24. Archived from the original on May 26, 2007.

articles.moneycentral.msn.com

- "Next: The real estate market freeze". MSN Money. 12 March 2007. Archived from the original on 14 August 2014. Retrieved 1 July 2007.

netdna-cdn.com

jrnetsolserver.shorensteincente.netdna-cdn.com

- Stafford, Frank; Chen, Bing; Schoeni, Robert (2012). "Mortgage Distress and Financial Liquidity: How U.S. Families are Handling Savings, Mortgages and Other Debts" (PDF). PSID. Institute for Social Research. Archived from the original (PDF) on 2013-05-11. Retrieved 2012-06-18.

newsweek.com

nytimes.com

- Krugman, Paul (2 January 2006). "No bubble trouble?". The New York Times.

Part of the rise in housing values since 2000 was justified given the fall in interest rates, but at this point the overall market value of housing has lost touch with economic reality. And there's a nasty correction ahead.

- Peters, Jeremy W. (26 July 2006). "Sales Slow for Homes New and Old". The New York Times. Retrieved 26 May 2010.

A variety of experts now say, the housing industry appears to be moving from a boom to something that is starting to look a lot like a bust

- "Editorial: It Was Fun While It Lasted". The New York Times. 5 September 2006.

With economic signals flashing that the housing boom is over, speculation has now turned to how deep the slump will be and how long it will last ... conventional wisdom holds that as long as you don't plan to sell your house any time soon ... you can cash in later. Or can you? The downturn in housing is overlapping with the retirement of the baby boom generation, which starts officially in 2008 ... Most of them are homeowners, and many of them will presumably want to sell their homes, extracting some cash for retirement in the process. Theoretically, that implies a glut of houses for sale, which would surely mitigate an upturn in prices, and could drive them ever lower. ... The house party is over, but we don't yet know how bad the hangover is going to be.

- Challenging the Crowd in Whispers, Not Shouts, Robert J Shiller, New York Times, 2008 Nov 1. As mentioned in Econned, by Yves Smith

- Creswell, Julie; Bajaj, Vikas (23 June 2007). "$3.2 Billion Move by Bear Stearns to Rescue Fund". The New York Times. Retrieved 26 May 2010.

- Bajaj, Vikas (10 April 2007). "Defaults Rise in Next Level of Mortgages". The New York Times. Retrieved 26 May 2010.

realestatecda.com

- "Can San Diego Home Prices Affect Coeur d'Alene Pricing?". Real Estate CDA. 28 October 2014.

realestatejournal.com

- Fletcher, June (19 July 2006). "Slowing Sales, Baby Boomers Spur a Glut of McMansions". The Wall Street Journal.

The golden age of McMansions may be coming to an end. These oversized homes—characterized by sprawling layouts on small lots, and built in cookie-cutter style by big developers—fueled much of the housing boom. But thanks to rising energy and mortgage costs, shrinking families and a growing number of retirement-age baby boomers set on downsizing, there are signs of an emerging glut. ... Some boomers in their late 50s are counting on selling their huge houses to help fund retirement. Yet a number of factors are weighing down demand. With the rise in home heating and cooling costs, McMansions are increasingly expensive to maintain. ... The overall slump in the housing market also is crimping big-home sales. ... Meantime, the jump in interest rates has put the cost of a big house out of more people's reach.

realtor.org

-

Lereah, David (17 August 2006). "Real Estate Reality Check". National Association of Realtors Leadership Summit. Archived from the original (PPT) on 1 September 2006. Retrieved 1 July 2007. NAR plot of Condominium Price Appreciation (percentages) in the south and west United States, 2002–2006:

Condominium Price Appreciation (percentages) in the south and west United States, 2002–2006. (Source: NAR.)

reason.com

- "The Truth About Fannie and Freddie's Role in the Housing Crisis". Reason.com. 2011-03-04. Retrieved 2014-02-21.

redfin.com

- Redfin (1970-01-01). "Home Buying Guide". Redfin. Retrieved 2022-03-20.

reuters.com

- "Merrill sells off assets from Bear hedge funds". Reuters. 21 June 2007.

- Poirier, John (2007-03-19). "Top five US subprime lenders asked to testify-Dodd". Reuters. Retrieved 2008-03-17.

rgemonitor.com

- "When mainstream analysts compare CDOs to "subslime", "toxic waste" and "six-inch hooker heels"..." RGE Monitor. 27 June 2007. Archived from the original on 29 June 2007. Retrieved 1 July 2007.

- Roubini, Nouriel (19 March 2007). "Who is to Blame for the Mortgage Carnage and Coming Financial Disaster? Unregulated Free Market Fundamentalism Zealotry". RGE Monitor. Archived from the original on 2007-07-05.

Greenspan allowed the tech bubble to fester by first warning about irrational exuberance and then doing nothing about via either monetary policy or, better, proper regulation of the financial system while at the same time becoming the "cheerleader of the new economy". And Greenspan/Bernanke allowed the housing bubble to develop in three ways of increasing importance: first, easy Fed Funds policy (but this was a minor role); second, being asleep at the wheel (together with all the banking regulators) in regulating housing lending; third, by becoming the cheerleaders of the monstrosities that were going under the name of "financial innovations" of housing finance. Specifically, Greenspan explicitly supported in public speeches the development and growth of the risky option ARMs and other exotic mortgage innovations that allowed the subprime and near-prime toxic waste to mushroom.

thehousingbubbleblog.com

- "Over 14,000 Phoenix For-Sale Homes Vacant". March 10, 2006. Plot of Phoenix inventory:

Inventory of houses for sale in Phoenix, AZ from July 2005 through March 2006. As of March 10, 2006, well over 14,000 (nearly half) of these for-sale homes are vacant. (Source: Arizona Regional Multiple Listing Service.)

timesonline.co.uk

business.timesonline.co.uk

- Searjeant, Graham (27 August 2005). "US heading for house price crash, Greenspan tells buyers". The Times. London. Retrieved 26 May 2010.

Alan Greenspan, the United States' central banker, warned American homebuyers that they risk a crash if they continue to drive property prices higher. ... On traditional tests, about a third of U.S. local homes markets are now markedly overpriced.

uni-muenchen.de

mpra.ub.uni-muenchen.de

- Bezemer, Dirk J, 16 June 2009. "“No One Saw This Coming”: Understanding Financial Crisis Through Accounting Models"

usatoday.com

- Lereah, David (24 August 2006). "Existing home sales drop 4.1% in July, median prices drop in most regions". USA Today.

- Knox, Noelle (10 August 2006). "For some, renting makes more sense". USA Today. Retrieved 26 May 2010.

usnews.com

- Paul J. Lim (13 June 2006). "Housing bubble correction could be severe". U.S. News & World Report. Archived from the original on 4 July 2007. Retrieved 22 October 2017.

web.archive.org

- Palmer, Christopher (2013-11-15). "Why did so many subprime borrowers default during the crisis: Loose credit or plummeting prices?" (PDF). Archived from the original (PDF) on 2017-05-17. Retrieved 2014-10-01.

- Paul J. Lim (13 June 2006). "Housing bubble correction could be severe". U.S. News & World Report. Archived from the original on 4 July 2007. Retrieved 22 October 2017.

-

Lereah, David (17 August 2006). "Real Estate Reality Check". National Association of Realtors Leadership Summit. Archived from the original (PPT) on 1 September 2006. Retrieved 1 July 2007. NAR plot of Condominium Price Appreciation (percentages) in the south and west United States, 2002–2006:

Condominium Price Appreciation (percentages) in the south and west United States, 2002–2006. (Source: NAR.) - "Mass. home foreclosures rise quickly". Boston Herald. 29 August 2006. Archived from the original on November 10, 2006.

- Paul Magnusson; Stan Crock; Peter Coy (19 December 2005). "Bubble, Bubble – Then Trouble: Is the chill in once-red-hot Loudoun County, Va., a portent of what's ahead?". BusinessWeek. Archived from the original on December 11, 2005.

- Fleckenstein, Bill (24 April 2006). "The housing bubble has popped". msnbc.com. Archived from the original on 30 April 2010. Retrieved 1 July 2007.

Reports of falling sales and investors stuck with properties they can't sell are just the beginning. Property owners should worry; so should their lenders.

- Lereah, David (1 January 2006). "Realtors' Lereah: Housing To Make 'Soft Landing'". Forbes. Archived from the original on October 13, 2007.

- Mozilo, Angelo (9 August 2006). "Countrywide Financial putting on the brakes". The Wall Street Journal. Archived from the original on 20 January 2007. Retrieved 1 July 2007.

- "Sales of new U.S. homes surged in April". msnbc.com. 2007-05-24. Archived from the original on May 26, 2007.

- Mara Der Hovanesian; Matthew Goldstein (7 March 2007). "The Mortgage Mess Spreads". BusinessWeek. Archived from the original on March 10, 2007.

- "When mainstream analysts compare CDOs to "subslime", "toxic waste" and "six-inch hooker heels"..." RGE Monitor. 27 June 2007. Archived from the original on 29 June 2007. Retrieved 1 July 2007.

- "Bear Stearns Hedge Fund Woes Stir Worry In CDO Market". Barrons. 21 June 2007. Archived from the original on 27 September 2007. Retrieved 1 July 2007.

- "Next: The real estate market freeze". MSN Money. 12 March 2007. Archived from the original on 14 August 2014. Retrieved 1 July 2007.

- Roubini, Nouriel (19 March 2007). "Who is to Blame for the Mortgage Carnage and Coming Financial Disaster? Unregulated Free Market Fundamentalism Zealotry". RGE Monitor. Archived from the original on 2007-07-05.

Greenspan allowed the tech bubble to fester by first warning about irrational exuberance and then doing nothing about via either monetary policy or, better, proper regulation of the financial system while at the same time becoming the "cheerleader of the new economy". And Greenspan/Bernanke allowed the housing bubble to develop in three ways of increasing importance: first, easy Fed Funds policy (but this was a minor role); second, being asleep at the wheel (together with all the banking regulators) in regulating housing lending; third, by becoming the cheerleaders of the monstrosities that were going under the name of "financial innovations" of housing finance. Specifically, Greenspan explicitly supported in public speeches the development and growth of the risky option ARMs and other exotic mortgage innovations that allowed the subprime and near-prime toxic waste to mushroom.

- Stafford, Frank; Chen, Bing; Schoeni, Robert (2012). "Mortgage Distress and Financial Liquidity: How U.S. Families are Handling Savings, Mortgages and Other Debts" (PDF). PSID. Institute for Social Research. Archived from the original (PDF) on 2013-05-11. Retrieved 2012-06-18.

wsj.com

- "Symposium: Did Alan Greenspan's Federal Reserve Cause the Housing Bubble? – WSJ". Wall Street Journal. 27 March 2009.

- Gregory Zuckerman (5 July 2006). "Surviving a Real-Estate Slowdown: A 'Loud Pop' Is Coming, But Mr. Heebner Sees Harm Limited to Inflated Regions". The Wall Street Journal.

A significant decline in prices is coming. A huge buildup of inventories is taking place, and then we're going to see a major [retrenchment] in hot markets in California, Arizona, Florida and up the East Coast. These markets could fall 50% from their peaks.

- Toll, Robert (23 August 2006). "Housing Slump Proves Painful For Some Owners and Builders: 'Hard Landing' on the Coasts Jolts Those Who Must Sell; Ms. Guth Tries an Auction; 'We're Preparing for the Worst'". The Wall Street Journal.

yahoo.com

finance.yahoo.com

- "Global Recession: Only Time Can Heal the Economy, Says Gary Shilling". finance.yahoo.com. 13 August 2012.

yale.edu

econ.yale.edu

- Case, Karl E.; Shiller, Robert J. "Is there a bubble in the housing market?" (PDF). Brookings Papers in Economic Activity. Cowles Foundation for Research in Economics, Yale University. Cowles Foundation Paper No. 1089.

youtube.com

- " Jdouche (November 2, 2008). "Peter Schiff Was Right 2006 – 2007 (2nd Edition)". Archived from the original on 2021-12-21.